Condo Insurance in and around Springfield

Condo unitowners of Springfield, State Farm has you covered.

Cover your home, wisely

Your Possessions Need Protection—and So Does Your Condo.

Owning a condo is a lot of responsiblity. You want to make sure your condo and personal property in it are protected in the event of some unexpected catastrophe or mishap. And you also want to be sure you have liability coverage in case someone becomes injured on your property.

Condo unitowners of Springfield, State Farm has you covered.

Cover your home, wisely

Agent Derek Hensley, At Your Service

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Derek Hensley is ready to help you navigate life’s troubles with dependable coverage for all your condo insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Derek Hensley can help you submit your claim. Keep your condo sweet condo with State Farm!

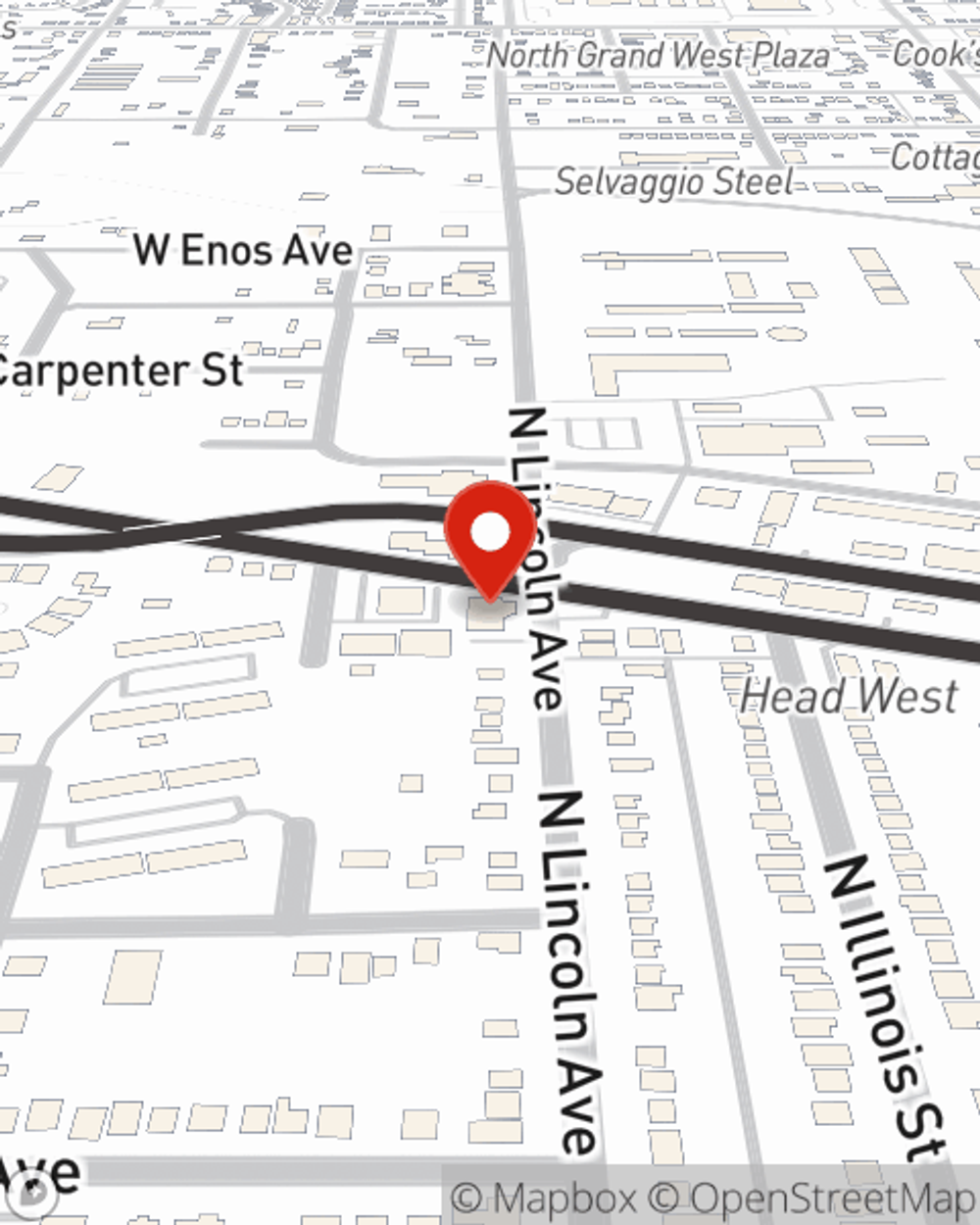

As one of the top providers of condo unitowners insurance, State Farm has you covered. Reach out to agent Derek Hensley today for help getting started.

Have More Questions About Condo Unitowners Insurance?

Call Derek at (217) 546-3434 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Derek Hensley

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.